07 May 2005 REUTERS/China Newsphoto

|

Come what come may, Time and the hour run through the roughest day.

William Shakespeare (1564-1616) |

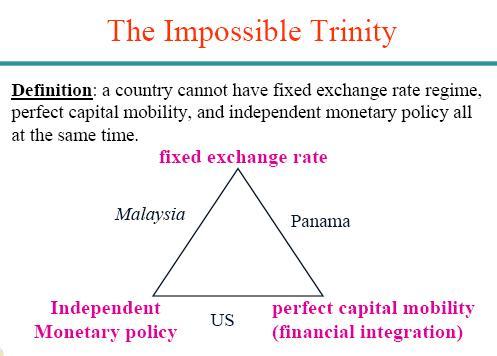

It is 'impossible' for straightforward reasons: if capital is free to move in and out, and the exchange rate is fixed, then money can swing in and out in huge quantities and play havoc with domestic inflation and interest rates -- which then rules out an "autonomous" monetary policy.

This is well known to economists, of course. And it provides a useful framework to understand what Y Venugopal Reddy, the RBI governor, is trying to do through monetary policy. Among other things, it might tell us what is in store as we move through the new financial year.

For a start, Dr Reddy has clearly indicated that the tolerance limit for inflation in India is now 5 per cent, if not less.

Old-timers will recall that the politically tolerable limit for inflation used to be reckoned as 10 per cent, while the long-term average inflation rate for India is around 7 per cent.

The limit today is not set by political compulsions, though. It is set by the fact that the inflation rate in the developed countries is about 2 per cent. If we want to integrate the Indian economy with the rest of the world, then our inflation rate must start getting closer to theirs.

But targeting a tighter inflation limit of 4-5 per cent means that both interest rates and money supply will be used far more frequently to stay within the acceptable inflation band (hence Dr Reddy's introduction of a new quarterly policy cycle).

And it is today's latent inflation that has persuaded Dr Reddy to signal higher interest rates early this week. What this suggests is a strong desire to have an autonomous monetary policy, directed at achieving clear domestic goals.

Take the exchange rate next. The RBI has traditionally tried to hold the "real" (i.e. inflation-adjusted) value of the rupee constant against a basket of currencies.

That undeclared policy still holds, which means that the RBI wants one of the legs of the trinity: stable exchange rates. Yet, the RBI does not always intervene to ensure that the rupee is valued as officially desired.

By one calculation the rupee today is about 4.5 per cent higher than what the "real value" policy would dictate. In that sense, the rupee is allowed to float within limits; as they say, it is a policy of "dirty float".

Then take the third leg of the impossible trinity: capital flows. If the rupee is ruling stronger than what the RBI would like, one reason is the strong capital flows into the country's stock market.

And at the interest rates that exist in the Indian system, even more money would come in and be invested in the debt market -- if the RBI would allow the big institutional players to do this.

But it won't, because this would affect all the variables negatively (as the RBI sees it): it would send the exchange rate even higher, and it would cause problems in managing the money supply (which would impact inflation).

Therefore, the RBI keeps a lid on further opening up to capital account convertibility, frustrating many reformers.

In short, the RBI is forced to have the rupee value float, but it will be a dirty float. It is willing to have some degree of capital account convertibility (FIIs do move in and out of the stock market, and other transactions too have been freed from controls), but within limits and only in some forms -- in other words, partial convertibility.

What it will not compromise on, it seems, are inflation and interest rates -- among other things, because the size of the government deficit translates into a government borrowing level that in some ways supersedes all other considerations.

If that were not there, the RBI would be willing to let the currency and money markets have a freer run, but that is not to be.

So, as someone in the RBI admitted frankly, for the foreseeable future the central bank's policy objective will have to remain the attainment of a "dirty trinity".