Now what exactly in money and what does the exchange rate movements signify. Since money is just paper, all its value comes from the faith that people have in its value. Inflation is something that eats into the purchasing power of money. How stable and strong the currency is depends on the inflation - and indirectly on the faith that poeple have in the central bank of a country. If they think the central bank would not let inflation be too high so that the money in their hand does not lose purchasing power, the currency would be relatively strong. Currency market is forward looking, i.e it inticipates what will happen in the future and incorporates that today. So if people sense that inflation would eat into their purchasing power, the currency will start losing value. This is generally in a longish time frame. Day to day fluctuations for currencies that float freely is just caused by supply and demand. Thinking of currencies as commodities, currencies which are in demand gain value and currencies in less demand lose value. The one certainty with currency markets is that it is nearly impossible to predict which way the currency will move and when. There are so many complex economic, political and financial factors that drive the whole thing.

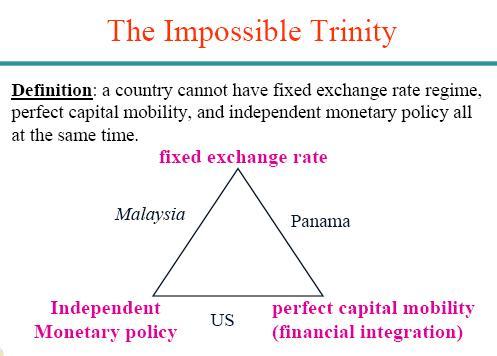

A cool concept is foreign exchange regimes is what is known as the impossible trinity. (Shown Below)

If a country tries to implement any of the two above, it has to forgo the third. Take the case of India. Say of we want an independent monetary policy and fixed exchange rate. In this case we would need to impose capital control. Why? Say lots of people want to invest in india and start demanding more and more rupees. This will cause the interest rates to rise. But we have an independent monetary policy, so the central bank buys bonds in the market and increases the money supply to ease the pressure. But under this situation it is impossible to maintian a fixed exchange rate cause the speculators see that your currency is appreciating and you are not allowing the value to go up. They will then launch attacks on your currency which you wont be able to defend for long since you have allowed free capital mobility.

Anyways, I found this article on rediff addressing same scenario wrt the RBI policies ..

RBI and the 'dirty trinity'

The "impossible trinity" in monetary policy is achieving three things at the same time: exchange rate stability, free flow of international capital and an autonomous monetary policy (which means the ability to target inflation and/or interest rates).

It is 'impossible' for straightforward reasons: if capital is free to move in and out, and the exchange rate is fixed, then money can swing in and out in huge quantities and play havoc with domestic inflation and interest rates -- which then rules out an "autonomous" monetary policy.

This is well known to economists, of course. And it provides a useful framework to understand what Y Venugopal Reddy, the RBI governor, is trying to do through monetary policy. Among other things, it might tell us what is in store as we move through the new financial year.

For a start, Dr Reddy has clearly indicated that the tolerance limit for inflation in India is now 5 per cent, if not less.

Old-timers will recall that the politically tolerable limit for inflation used to be reckoned as 10 per cent, while the long-term average inflation rate for India is around 7 per cent.

The limit today is not set by political compulsions, though. It is set by the fact that the inflation rate in the developed countries is about 2 per cent. If we want to integrate the Indian economy with the rest of the world, then our inflation rate must start getting closer to theirs.

But targeting a tighter inflation limit of 4-5 per cent means that both interest rates and money supply will be used far more frequently to stay within the acceptable inflation band (hence Dr Reddy's introduction of a new quarterly policy cycle).

And it is today's latent inflation that has persuaded Dr Reddy to signal higher interest rates early this week. What this suggests is a strong desire to have an autonomous monetary policy, directed at achieving clear domestic goals.

Take the exchange rate next. The RBI has traditionally tried to hold the "real" (i.e. inflation-adjusted) value of the rupee constant against a basket of currencies.

That undeclared policy still holds, which means that the RBI wants one of the legs of the trinity: stable exchange rates. Yet, the RBI does not always intervene to ensure that the rupee is valued as officially desired.

By one calculation the rupee today is about 4.5 per cent higher than what the "real value" policy would dictate. In that sense, the rupee is allowed to float within limits; as they say, it is a policy of "dirty float".

Then take the third leg of the impossible trinity: capital flows. If the rupee is ruling stronger than what the RBI would like, one reason is the strong capital flows into the country's stock market.

And at the interest rates that exist in the Indian system, even more money would come in and be invested in the debt market -- if the RBI would allow the big institutional players to do this.

But it won't, because this would affect all the variables negatively (as the RBI sees it): it would send the exchange rate even higher, and it would cause problems in managing the money supply (which would impact inflation).

Therefore, the RBI keeps a lid on further opening up to capital account convertibility, frustrating many reformers.

In short, the RBI is forced to have the rupee value float, but it will be a dirty float. It is willing to have some degree of capital account convertibility (FIIs do move in and out of the stock market, and other transactions too have been freed from controls), but within limits and only in some forms -- in other words, partial convertibility.

What it will not compromise on, it seems, are inflation and interest rates -- among other things, because the size of the government deficit translates into a government borrowing level that in some ways supersedes all other considerations.

If that were not there, the RBI would be willing to let the currency and money markets have a freer run, but that is not to be.

So, as someone in the RBI admitted frankly, for the foreseeable future the central bank's policy objective will have to remain the attainment of a "dirty trinity".

No comments:

Post a Comment